resources

Designed with you in mind

Debt

Understand how debt really affects your finances

“Never spend your money before you have it.” – Thomas Jefferson

Debt is defined as anything that is owed or due.

In the world of finance, debt is when an individual or business borrows money from a bank or financial institution to be paid back at a later date, with interest.

Short list of debt types

- Credit cards

- Car notes

- Student loans

- Rent to own purchases

- Homes / mortgages

- Personal loans

“Never spend your money before you have it.” – Thomas Jefferson

Debt is defined as anything that is owed or due.

In the world of finance, debt is when an individual or business borrows money from a bank or financial institution to be paid back at a later date, with interest.

Short list of debt types

- Credit cards

- Car notes

- Student loans

- Rent to own purchases

- Homes / mortgages

- Personal loans

debt is a silent killer of wealth

Most people think of debt as a useful tool in the world of finance.

The reality is that debt is a silent killer for building wealth for two reasons:

- It “kills” the opportunity to build wealth because instead of earning interest in savings or investments, you are paying it in fees and/or interest.

- It is so widely advertised as a helpful tool that it is universally accepted as a good thing for people to have and use.

debt is a silent killer of wealth

Most people think of debt as a useful tool in the world of finance.

The reality is that debt is a silent killer for building wealth for two reasons:

- It “kills” the opportunity to build wealth because instead of earning interest in savings or investments, you are paying it in fees and/or interest.

- It is so widely advertised as a helpful tool that it is universally accepted as a good thing for people to have and use.

“The only man who sticks closer to you in adversity than a friend is a creditor.” – Unknown

If I told you I would give you $10 today BUT next week you had to give me $100, would you do it? (if your answer is yes, I have some money you can borrow).

This sums up the main reason why you should not use debt and why it is so hard to build wealth by using it.

The reality is that debt is a tool financial institutions and investors use to prey on your impulses, impatience and sometimes ignorance so they can build wealth with your money!

“The only man who sticks closer to you in adversity than a friend is a creditor.” – Unknown

If I told you I would give you $10 today BUT next week you had to give me $100, would you do it? (if your answer is yes, I have some money you can borrow).

This sums up the main reason why you should not use debt and why it is so hard to build wealth by using it.

The reality is that debt is a tool financial institutions and investors use to prey on your impulses, impatience and sometimes ignorance so they can build wealth with your money!

how much debt really costs you

According to a recent survey, the value of household debt as of June 2020 is estimated at 14.3 trillion dollars! Below are the top categories in the US.

1. Mortgages – 9.78 trillion

2. Student loans – 1.54 trillion

3. Auto loans – 1.34 trillion

4. Credit cards – 0.41 trillion

how much debt really costs you

According to a recent survey, the value of household debt as of June 2020 is estimated at 14.3 trillion dollars! Below are the top categories of debt in the US.

1. Mortgages – 9.78 trillion

2. Student loans – 1.54 trillion

3. Auto loans – 1.34 trillion

4. Credit cards – 0.41 trillion

Do you Really Need Debt?

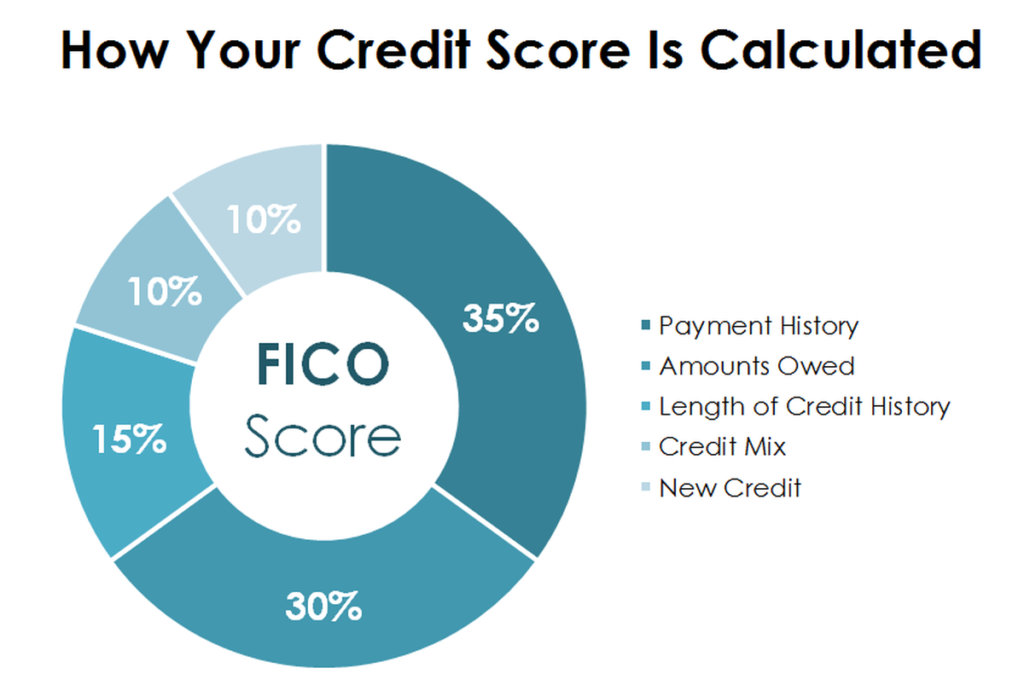

Your credit score, or FICO score is used to determine the level of risk in loaning you money. It does this by looking at 5 areas.

The most common excuse reason people say they use debt is to build their credit score. By having a high credit score, this lowers the potential interest rate ON MORE DEBT!

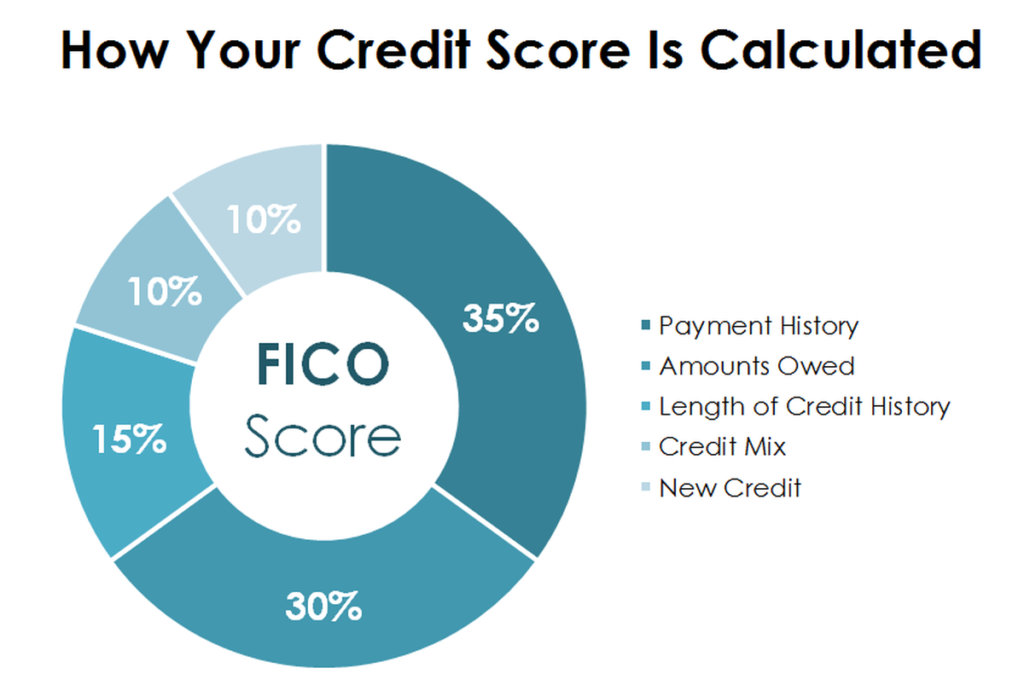

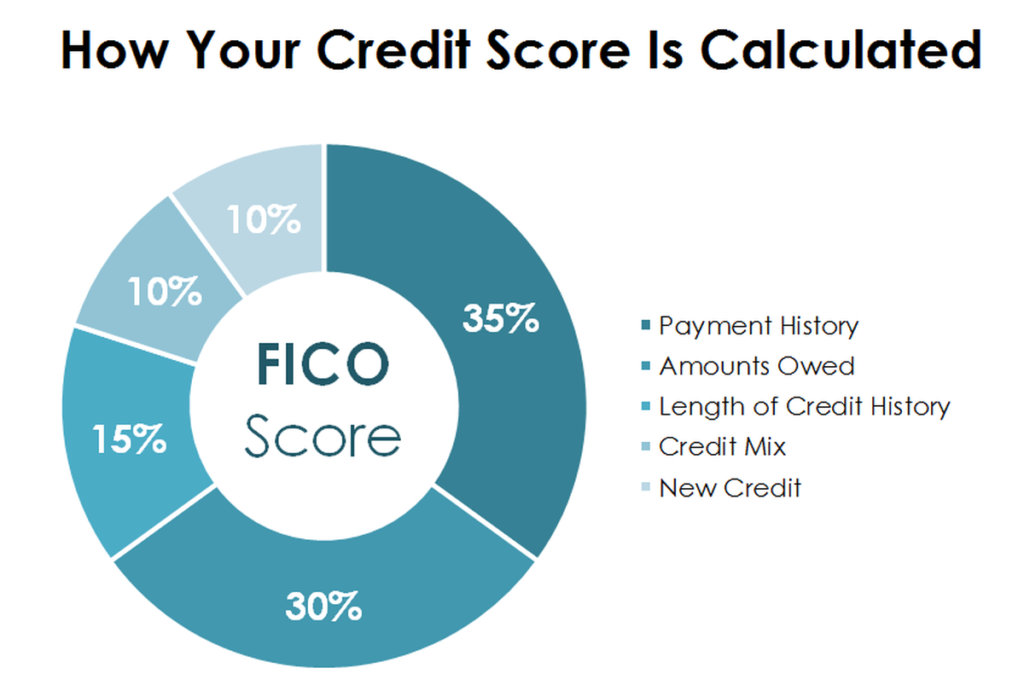

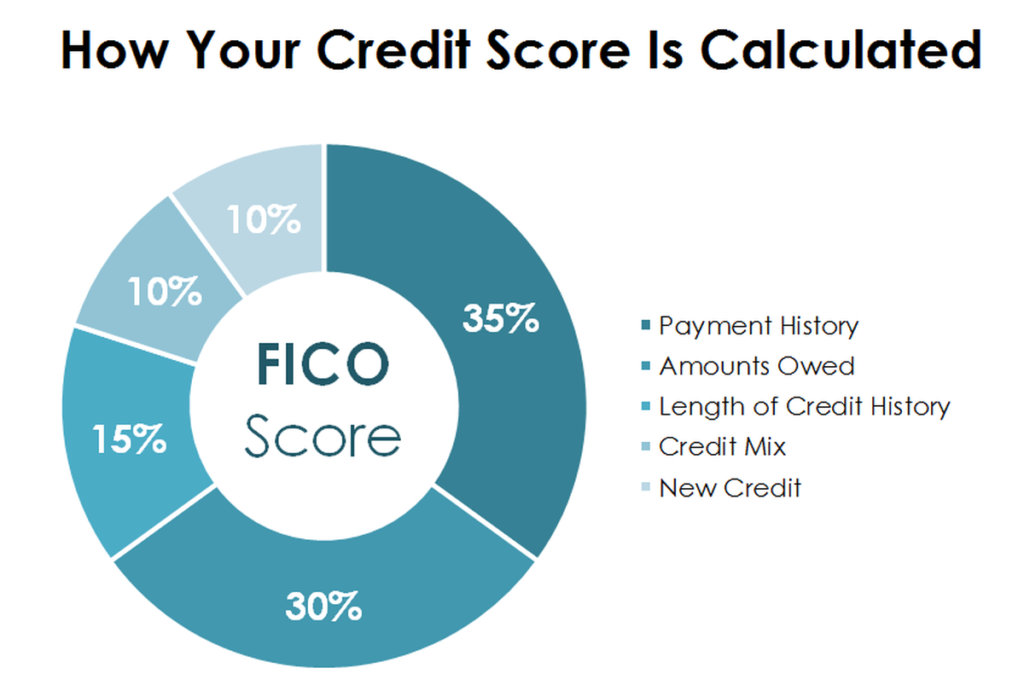

Do you Really Need Debt?

Your credit score, or FICO score is used to determine the level of risk in loaning you money. It does this by looking at 5 areas.

The most common excuse reason people say they use debt is to build their credit score. By having a high credit score, this lowers the potential interest rate ON MORE DEBT!

9 Reasons Debt Is Bad for You

- Debt Encourages You to Spend More Than You Can Afford

- Debt Costs Money

- Debt Borrows From Your Future Income

- High-Interest Debt Causes You to Pay More Than the Item Cost

- Debt Keeps You From Reaching Your Financial Goals

- Debt Can Keep You From Owning a Home

- Debt Can Lead to Stress and Serious Medical Problems

- Debt Can Hurt Your Marriage

- Debt Hurts Your Credit Score

9 Reasons Debt Is Bad for You

- Debt Encourages You to Spend More Than You Can Afford

- Debt Costs Money

- Debt Borrows From Your Future Income

- High-Interest Debt Causes You to Pay More Than the Item Cost

- Debt Keeps You From Reaching Your Financial Goals

- Debt Can Keep You From Owning a Home

- Debt Can Lead to Stress and Serious Medical Problems

- Debt Can Hurt Your Marriage

- Debt Hurts Your Credit Score

Debt and Loans

Use these to see how soon you can pay off your debt.

Debt and Loans

Use these to see how soon you can pay off your debt.

debt links

debt there be light

What if, hypothetically, you didn’t use debt AT ALL, would you need a credit score?

Imagine how much money you could have if you did not have any debt. You would be in a great position to build long-term wealth.

Let our team unlock your potential to win with your money.

debt there be light

What if, hypothetically, you didn’t use debt AT ALL, would you need a credit score?

Imagine how much money you could have if you did not have any debt. You would be in a great position to build long-term wealth.

Let our team unlock your potential to win with your money.

“Never spend your money before you have it.” – Thomas Jefferson

Debt is defined as anything that is owed or due.

In the world of finance, debt is when an individual or business borrows money from a bank or financial institution to be paid back at a later date, with interest.

Short list of debt types

- Credit cards

- Car notes

- Student loans

- Rent to own purchases

- Homes / mortgages

- Personal loans

“Never spend your money before you have it.” – Thomas Jefferson

Debt is defined as anything that is owed or due.

In the world of finance, debt is when an individual or business borrows money from a bank or financial institution to be paid back at a later date, with interest.

Short list of debt types

- Credit cards

- Car notes

- Student loans

- Rent to own purchases

- Homes / mortgages

- Personal loans

debt is a silent killer of wealth

Most people think of debt as a useful tool in the world of finance.

The reality is that debt is a silent killer for building wealth for two reasons:

- It “kills” the opportunity to build wealth because instead of earning interest in savings or investments, you are paying it in fees and/or interest.

- It is so widely advertised as a helpful tool that it is universally accepted as a good thing for people to have and use.

debt is a silent killer of wealth

Most people think of debt as a useful tool in the world of finance.

The reality is that debt is a silent killer for building wealth for two reasons:

- It “kills” the opportunity to build wealth because instead of earning interest in savings or investments, you are paying it in fees and/or interest.

- It is so widely advertised as a helpful tool that it is universally accepted as a good thing for people to have and use.

“The only man who sticks closer to you in adversity than a friend is a creditor.” – Unknown

If I told you I would give you $10 today BUT next week you had to give me $100, would you do it? (if your answer is yes, I have some money you can borrow).

This sums up the main reason why you should not use debt and why it is so hard to build wealth by using it.

The reality is that debt is a tool financial institutions and investors use to prey on your impulses, impatience and sometimes ignorance so they can build wealth with your money!

“The only man who sticks closer to you in adversity than a friend is a creditor.” – Unknown

If I told you I would give you $10 today BUT next week you had to give me $100, would you do it? (if your answer is yes, I have some money you can borrow).

This sums up the main reason why you should not use debt and why it is so hard to build wealth by using it.

The reality is that debt is a tool financial institutions and investors use to prey on your impulses, impatience and sometimes ignorance so they can build wealth with your money!

how much debt really costs you

According to a recent survey, the value of household debt as of June 2020 is estimated at 14.3 trillion dollars! Below are the top categories in the US.

1. Mortgages – 9.78 trillion

2. Student loans – 1.54 trillion

3. Auto loans – 1.34 trillion

4. Credit cards – 0.41 trillion

how much debt really costs you

According to a recent survey, the value of household debt as of June 2020 is estimated at 14.3 trillion dollars! Below are the top categories of debt in the US.

1. Mortgages – 9.78 trillion

2. Student loans – 1.54 trillion

3. Auto loans – 1.34 trillion

4. Credit cards – 0.41 trillion

Do you Really Need Debt?

Your credit score, or FICO score is used to determine the level of risk in loaning you money. It does this by looking at 5 areas.

The most common excuse reason people say they use debt is to build their credit score. By having a high credit score, this lowers the potential interest rate ON MORE DEBT!

Do you Really Need Debt?

Your credit score, or FICO score is used to determine the level of risk in loaning you money. It does this by looking at 5 areas.

The most common excuse reason people say they use debt is to build their credit score. By having a high credit score, this lowers the potential interest rate ON MORE DEBT!

9 Reasons Debt Is Bad for You

- Debt Encourages You to Spend More Than You Can Afford

- Debt Costs Money

- Debt Borrows From Your Future Income

- High-Interest Debt Causes You to Pay More Than the Item Cost

- Debt Keeps You From Reaching Your Financial Goals

- Debt Can Keep You From Owning a Home

- Debt Can Lead to Stress and Serious Medical Problems

- Debt Can Hurt Your Marriage

- Debt Hurts Your Credit Score

9 Reasons Debt Is Bad for You

- Debt Encourages You to Spend More Than You Can Afford

- Debt Costs Money

- Debt Borrows From Your Future Income

- High-Interest Debt Causes You to Pay More Than the Item Cost

- Debt Keeps You From Reaching Your Financial Goals

- Debt Can Keep You From Owning a Home

- Debt Can Lead to Stress and Serious Medical Problems

- Debt Can Hurt Your Marriage

- Debt Hurts Your Credit Score

Debt and Loans

Use these to see how soon you can pay off your debt.

Debt and Loans

Use these to see how soon you can pay off your debt.

debt links

debt there be light

What if, hypothetically, you didn’t use debt AT ALL, would you need a credit score?

Imagine how much money you could have if you did not have any debt. You would be in a great position to build long-term wealth.

Let our team unlock your potential to win with your money.

debt there be light

What if, hypothetically, you didn’t use debt AT ALL, would you need a credit score?

Imagine how much money you could have if you did not have any debt. You would be in a great position to build long-term wealth.

Let our team unlock your potential to win with your money.

Have you tried our Financial Health Assessment?

also Explore these other free tools and resources

Tools

Useful tools to help you track, manage and understand your money

Webinars

Virtual classes for people of all ages discussing a wide range of topics.