resources

Designed with you in mind

Savings

View ways to increase your savings

“Do not save what is left after spending, but spend what is left after saving.” – Warren Buffett

Saving is the act of holding or putting away money to be used at a later date. The most common way to do this is to put money in a savings account.

Examples:

- Traditional savings account (banks, credit unions)

- Money Market Deposit accounts

- Certificate of Deposit (CDs)

Savings accounts should not be viewed as investments. Savings accounts should be seen as a way to access your money quickly and easily for short term necessities.

“Do not save what is left after spending, but spend what is left after saving.” – Warren Buffett

Saving is the act of holding or putting away money to be used at a later date. The most common way to do this is to put money in a savings account.

Examples:

- Traditional savings account (banks, credit unions)

- Money Market Deposit accounts

- Certificate of Deposit (CDs)

Savings accounts should not be viewed as investments. Savings accounts should be seen as a way to access your money quickly and easily for short term necessities.

When most people think about saving money, it is usually for a vacation or a big purchase. However, we encourage our clients to look at saving money as financial protection from future life events.

Your savings should be seen as an emergency or “rainy-day” fund to lessen the burden of paying for large unexpected purchases.

Types of emergencies

- Auto repair / accident

- Medical surgery or treatment

- HVAC repair

- Home flood

- Job loss / Unemployment

Save money and money will save you

Save money and money will save you

When most people think about saving money, it is usually for a vacation or a big purchase.

We encourage our clients to look at saving money as financial protection from future life events.

Your savings should be seen as an emergency or “rainy-day” fund to lessen the burden of paying for large unexpected purchases.

Types of emergencies

- Auto repair / accident

- Medical surgery or treatment

- HVAC repair

- Home flood

- Job loss / Unemployment

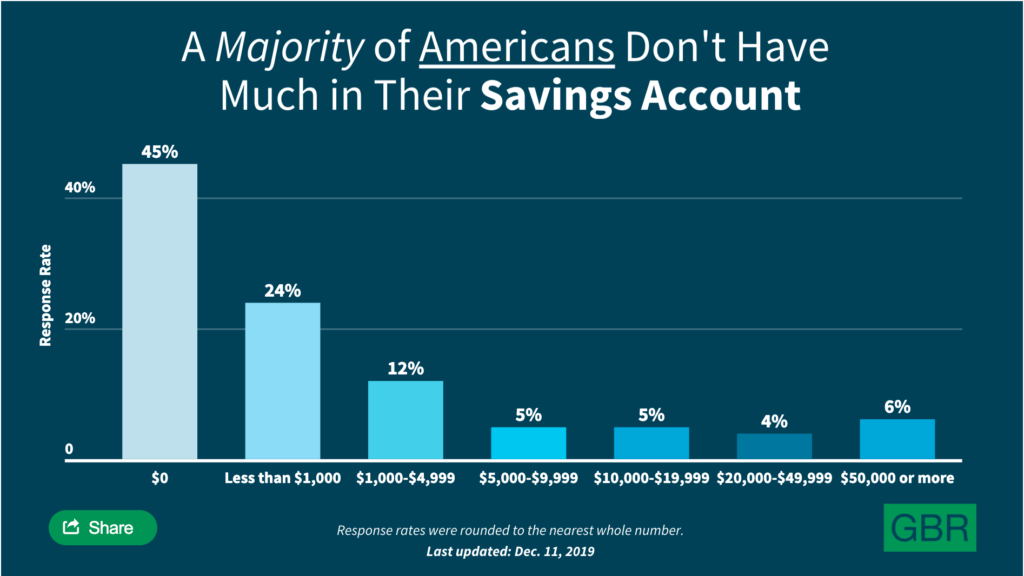

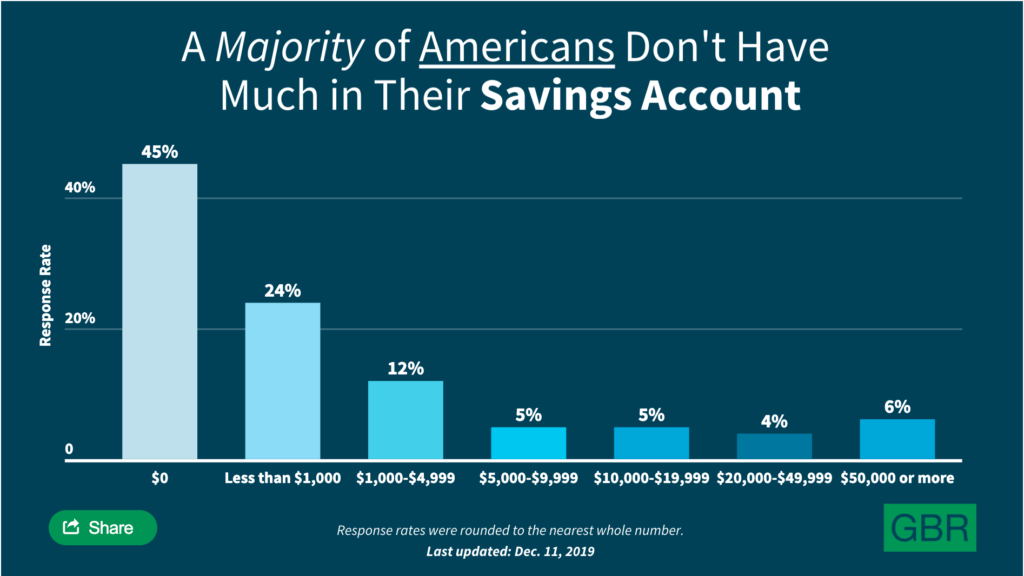

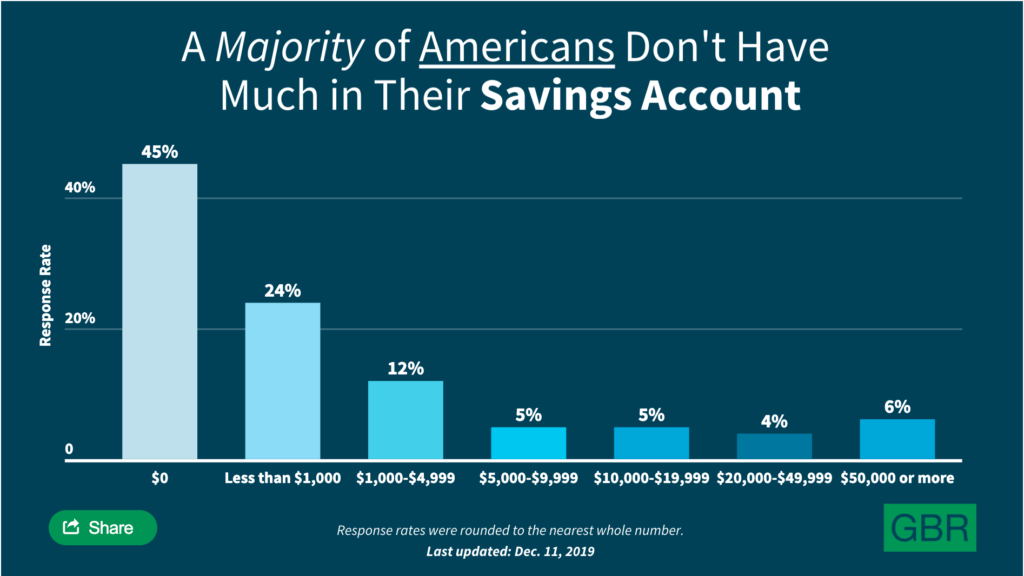

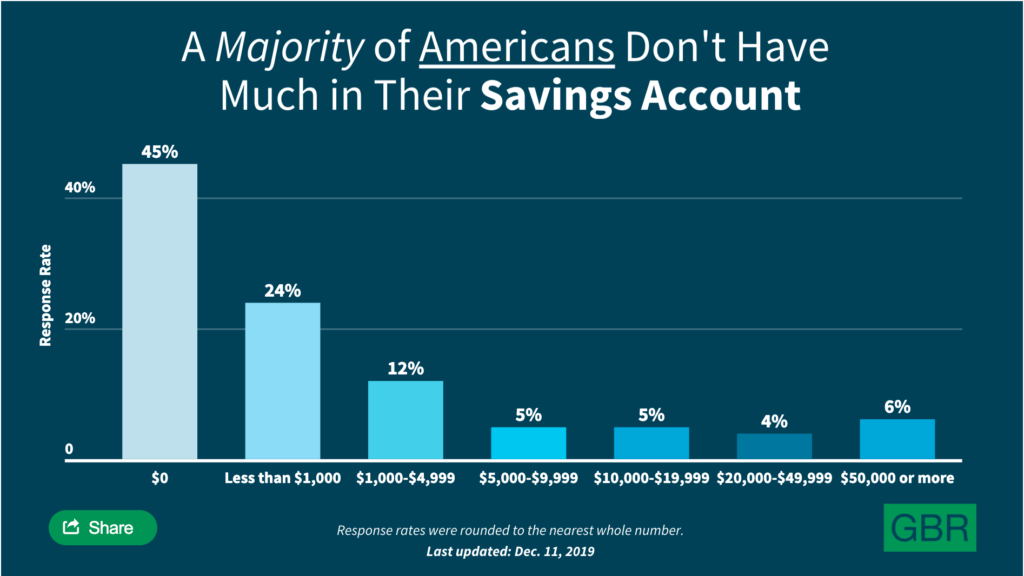

69% of Americans have less than $1,000 in savings.

69% of Americans have less than $1,000 in savings.

The emergency fund is your biggest lifeline when it comes to building wealth.

Also known as a “rainy day” fund, this money should be set aside to deal with UNEXPECTED events.

Emergency fund characteristics

- Should be liquid or easy to access

- Preferably a high yield savings account or money market.

- Should be viewed as a short-term solution

- Should not be used for investments or risky ventures

The emergency fund is your biggest lifeline when it comes to building wealth.

Also known as a “rainy day” fund, this money should be set aside to deal with UNEXPECTED events.

Emergency fund characteristics

- Should be liquid or easy to access

- Preferably a high yield savings account or money market

- Should be viewed as a short-term solution

- Should not be used for investments or risky ventures

cutting expenses can save a lot of money

Just as important as it is to put away money to save, you can also save money by lowering expenses or purchases.

Ways to cut back expenses

- Cancel or suspend subscription services like Netflix or Hulu

- Reducing Starbucks by 1 day can save over $100/month

- Buy used (like new) or refurbished

- Lower cable or phone plans

- Limit dining out and social activities

- Prepaying auto insurance 6-12 months ahead

cutting expenses can save a lot of money

Just as important as it is to put away money to save, you can also save money by lowering expenses or purchases.

Ways to cut back expenses

- Cancel or suspend subscription services like Netflix or Hulu

- Reducing Starbucks by 1 day can save over $100/month

- Buy used (like new) or refurbished

- Lower cable or phone plans

- Limit dining out and social activities

- Prepaying auto insurance 6-12 months ahead

Savings is your new credit

If you could pay for any unexpected emergency, with cash, would you really need a credit card?

Having about 3-6 months of expenses in a savings account would cover most emergencies and insurance deductibles out-of-pocket.

Doing this is helpful in building wealth because you no longer need to borrow money to pay for any unexpected expenses.

Savings is your new credit

If you could pay for any unexpected emergency, with cash, would you really need a credit card?

Having about 3-6 months of expenses in a savings account would cover most emergencies and insurance deductibles out-of-pocket.

Doing this is helpful in building wealth because you no longer need to borrow money to pay for any unexpected expenses.

Savings

Use these to see how your money can grow.

Savings

Use these to see how your money can grow.

in case of emergencies…

If you have an emergency fund of 3-6 months of expenses, you will be able to pay for most emergencies without borrowing money!

This will increase the ability to save more, do more, and live more with your money.

Book a session today with a financial coach to get a personalized plan to build your savings.

in case of emergencies…

If you have an emergency fund of 3-6 months of expenses, you will be able to pay for most emergencies without borrowing money!

This will increase the ability to save more, do more, and live more with your money.

Book a session today with a financial coach to get a personalized plan to build your savings.

“Do not save what is left after spending, but spend what is left after saving.” – Warren Buffett

Saving is the act of holding or putting away money to be used at a later date. The most common way to do this is to put money in a savings account.

Examples:

- Traditional savings account (banks, credit unions)

- Money Market Deposit accounts

- Certificate of Deposit (CDs)

Savings accounts should not be viewed as investments. Savings accounts should be seen as a way to access your money quickly and easily for short term necessities.

“Do not save what is left after spending, but spend what is left after saving.” – Warren Buffett

Saving is the act of holding or putting away money to be used at a later date. The most common way to do this is to put money in a savings account.

Examples:

- Traditional savings account (banks, credit unions)

- Money Market Deposit accounts

- Certificate of Deposit (CDs)

Savings accounts should not be viewed as investments. Savings accounts should be seen as a way to access your money quickly and easily for short term necessities.

When most people think about saving money, it is usually for a vacation or a big purchase. However, we encourage our clients to look at saving money as financial protection from future life events.

Your savings should be seen as an emergency or “rainy-day” fund to lessen the burden of paying for large unexpected purchases.

Types of emergencies

- Auto repair / accident

- Medical surgery or treatment

- HVAC repair

- Home flood

- Job loss / Unemployment

Save money and money will save you

Save money and money will save you

When most people think about saving money, it is usually for a vacation or a big purchase.

We encourage our clients to look at saving money as financial protection from future life events.

Your savings should be seen as an emergency or “rainy-day” fund to lessen the burden of paying for large unexpected purchases.

Types of emergencies

- Auto repair / accident

- Medical surgery or treatment

- HVAC repair

- Home flood

- Job loss / Unemployment

69% of Americans have less than $1,000 in savings.

69% of Americans have less than $1,000 in savings.

The emergency fund is your biggest lifeline when it comes to building wealth.

Also known as a “rainy day” fund, this money should be set aside to deal with UNEXPECTED events.

Emergency fund characteristics

- Should be liquid or easy to access

- Preferably a high yield savings account or money market.

- Should be viewed as a short-term solution

- Should not be used for investments or risky ventures

The emergency fund is your biggest lifeline when it comes to building wealth.

Also known as a “rainy day” fund, this money should be set aside to deal with UNEXPECTED events.

Emergency fund characteristics

- Should be liquid or easy to access

- Preferably a high yield savings account or money market

- Should be viewed as a short-term solution

- Should not be used for investments or risky ventures

cutting expenses can save a lot of money

Just as important as it is to put away money to save, you can also save money by lowering expenses or purchases.

Ways to cut back expenses

- Cancel or suspend subscription services like Netflix or Hulu

- Reducing Starbucks by 1 day can save over $100/month

- Buy used (like new) or refurbished

- Lower cable or phone plans

- Limit dining out and social activities

- Prepaying auto insurance 6-12 months ahead

cutting expenses can save a lot of money

Just as important as it is to put away money to save, you can also save money by lowering expenses or purchases.

Ways to cut back expenses

- Cancel or suspend subscription services like Netflix or Hulu

- Reducing Starbucks by 1 day can save over $100/month

- Buy used (like new) or refurbished

- Lower cable or phone plans

- Limit dining out and social activities

- Prepaying auto insurance 6-12 months ahead

Savings is your new credit

If you could pay for any unexpected emergency, with cash, would you really need a credit card?

Having about 3-6 months of expenses in a savings account would cover most emergencies and insurance deductibles out-of-pocket.

Doing this is helpful in building wealth because you no longer need to borrow money to pay for any unexpected expenses.

Savings is your new credit

If you could pay for any unexpected emergency, with cash, would you really need a credit card?

Having about 3-6 months of expenses in a savings account would cover most emergencies and insurance deductibles out-of-pocket.

Doing this is helpful in building wealth because you no longer need to borrow money to pay for any unexpected expenses.

Savings

Use these to see how your money can grow.

Savings

Use these to see how your money can grow.

in case of emergencies…

If you have an emergency fund of 3-6 months of expenses, you will be able to pay for most emergencies without borrowing money!

This will increase the ability to save more, do more, and live more with your money.

Book a session today with a financial coach to get a personalized plan to build your savings.

in case of emergencies…

If you have an emergency fund of 3-6 months of expenses, you will be able to pay for most emergencies without borrowing money!

This will increase the ability to save more, do more, and live more with your money.

Book a session today with a financial coach to get a personalized plan to build your savings.

Have you tried our Financial Health Assessment?

also Explore these other free tools and resources

Tools

Useful tools to help you track, manage and understand your money

Webinars

Virtual classes for people of all ages discussing a wide range of topics.