resources

Designed with you in mind

Budgeting

Analyze, track and manage your money

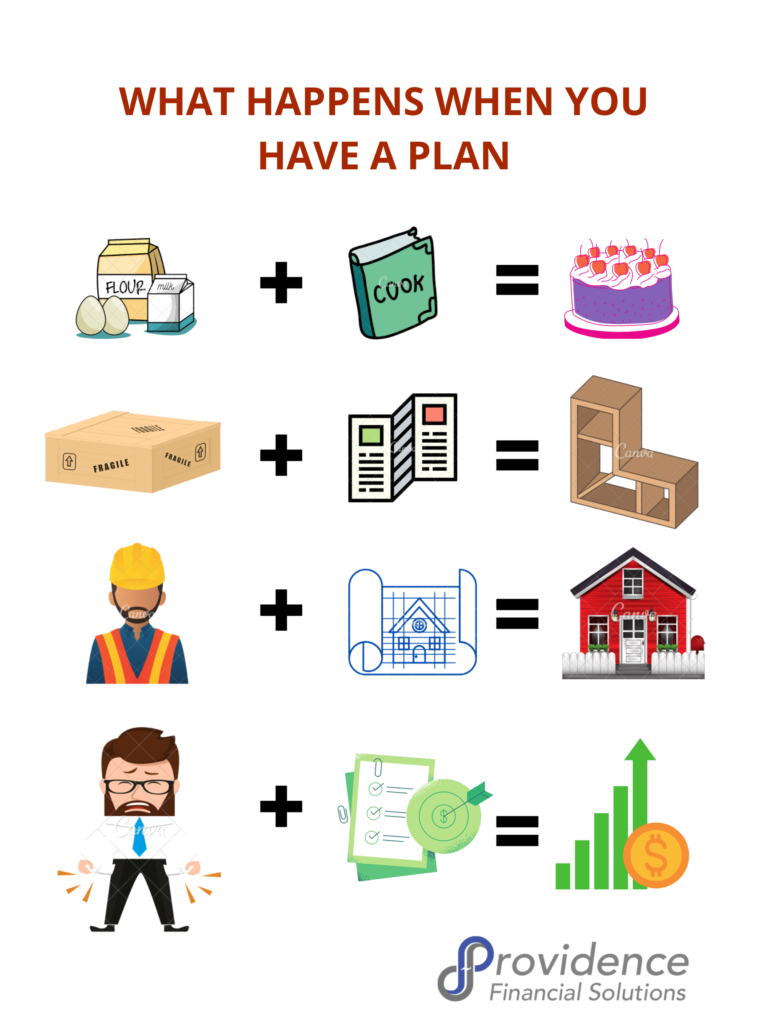

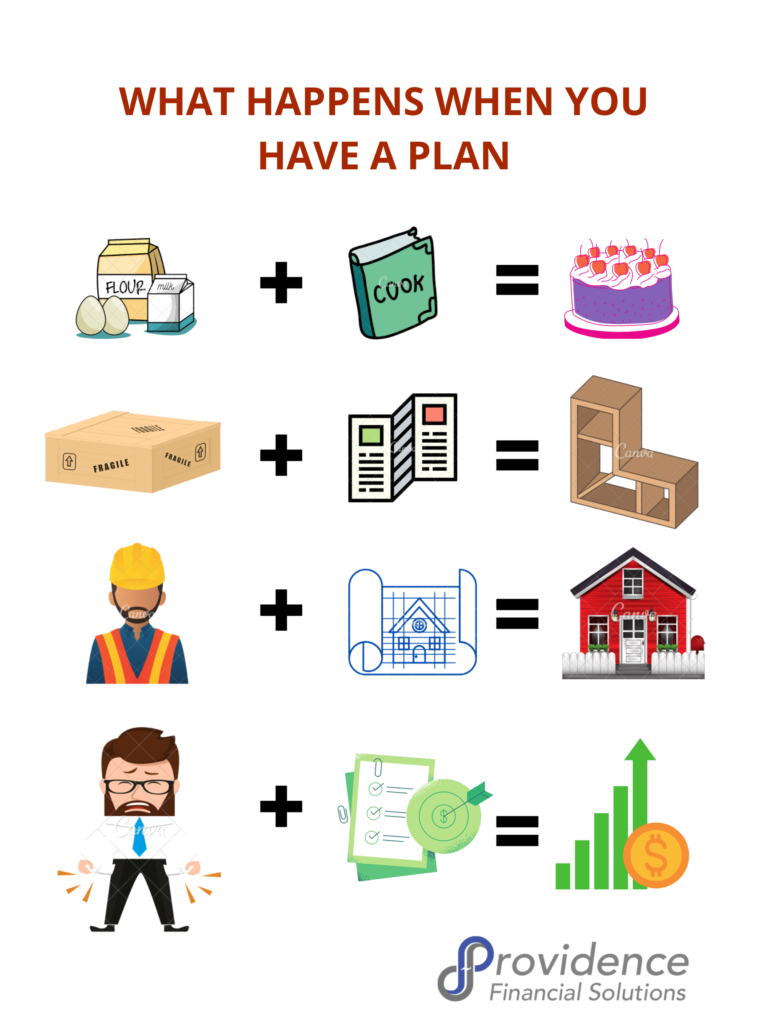

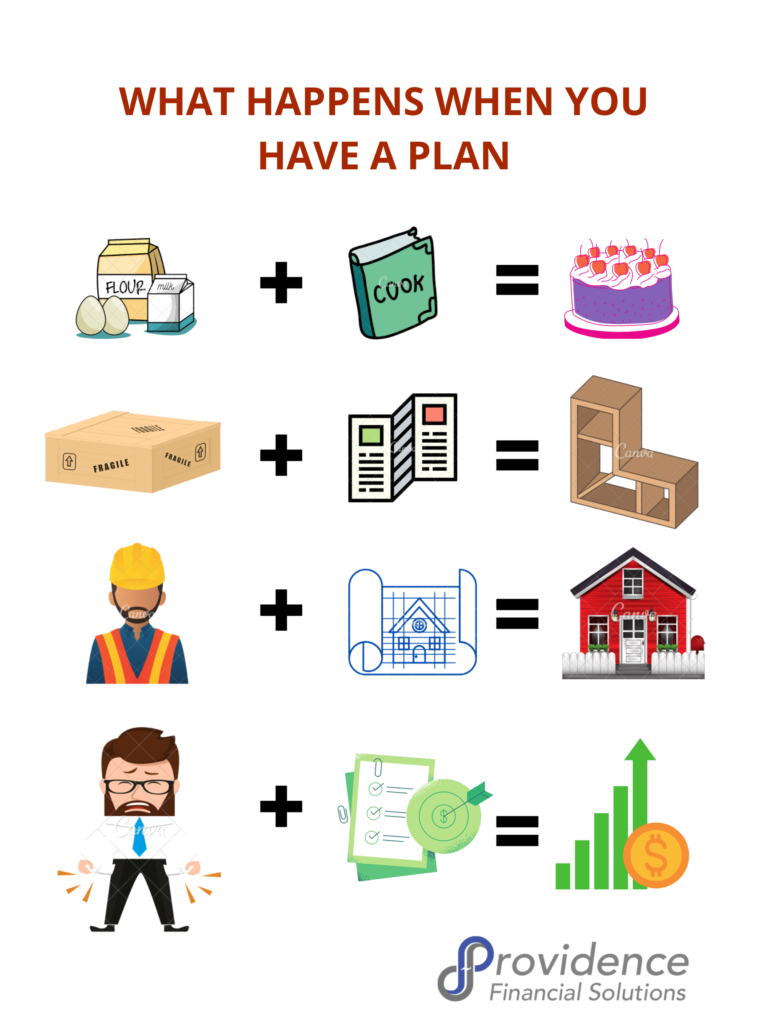

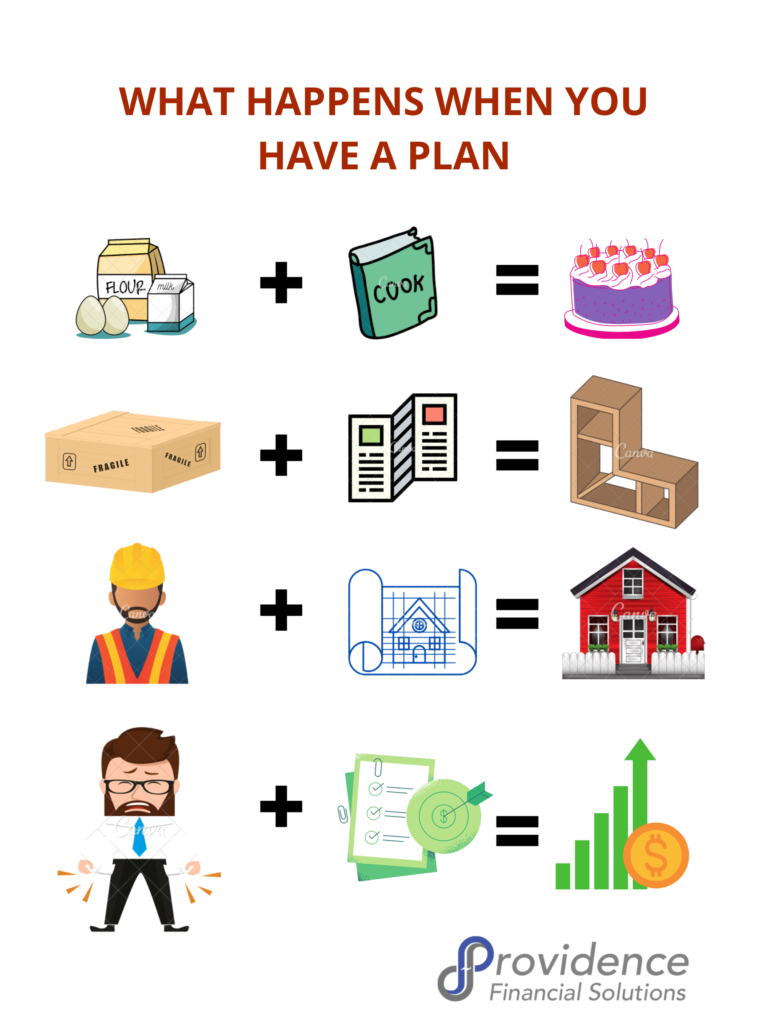

“If you fail to plan, you plan to fail”” – Benjamin Franklin

A budget is simply a WRITTEN RECORD of the income and expenses that you EXPECT to have for a given period of time.

Many people cringe at that word but a budget is just YOUR plan to save, give, or spend YOUR money.

“If you fail to plan, you plan to fail”” – Benjamin Franklin

A budget is simply a WRITTEN RECORD of the income and expenses that you EXPECT to have for a given period of time.

Many people cringe at that word but a budget is just YOUR plan to save, give, or spend YOUR money.

Only around 1/4 of Americans have some kind of written financial plan

Only around 1/4 of Americans have some kind of written financial plan

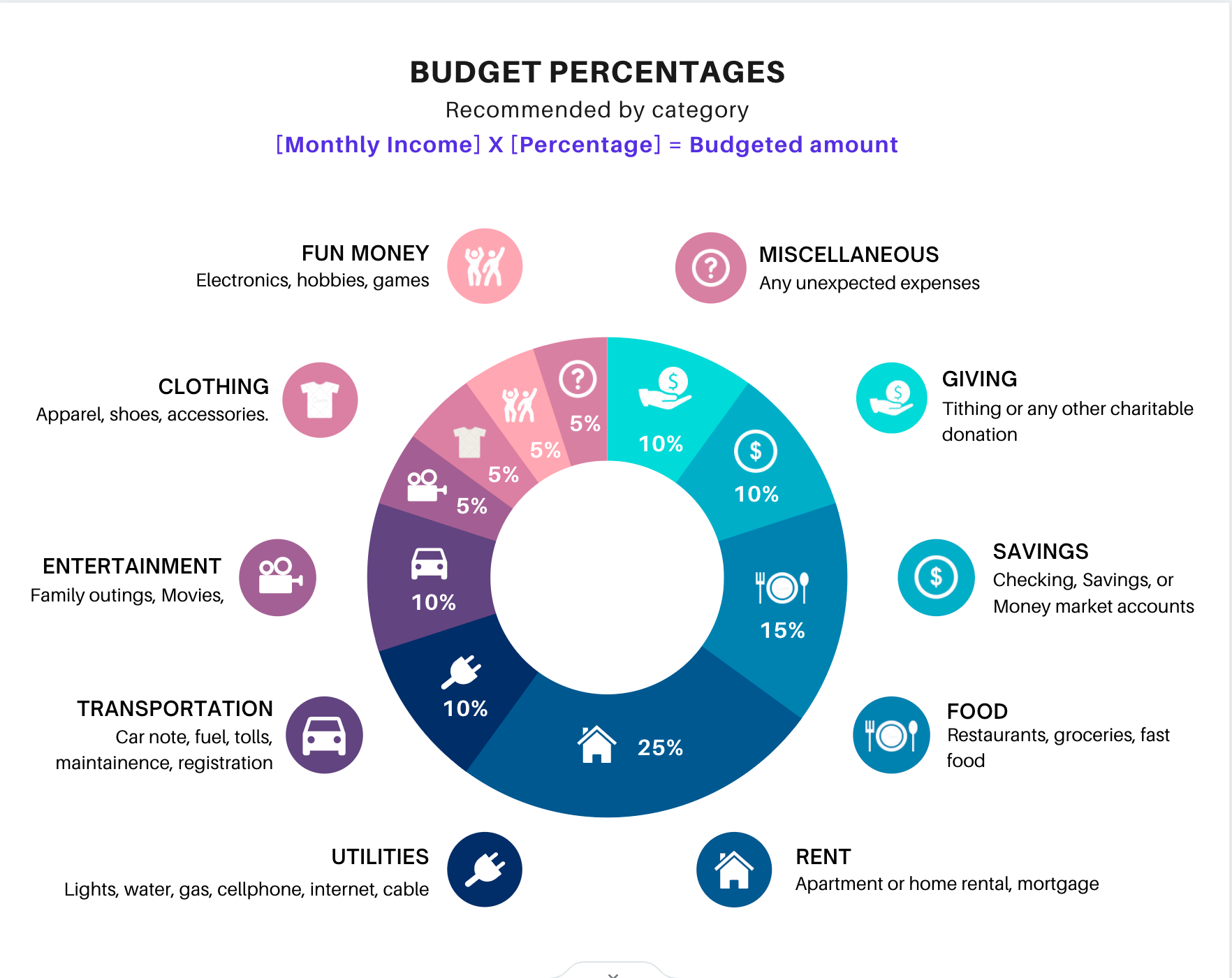

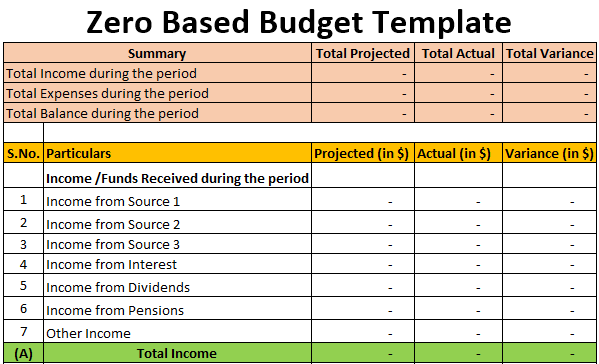

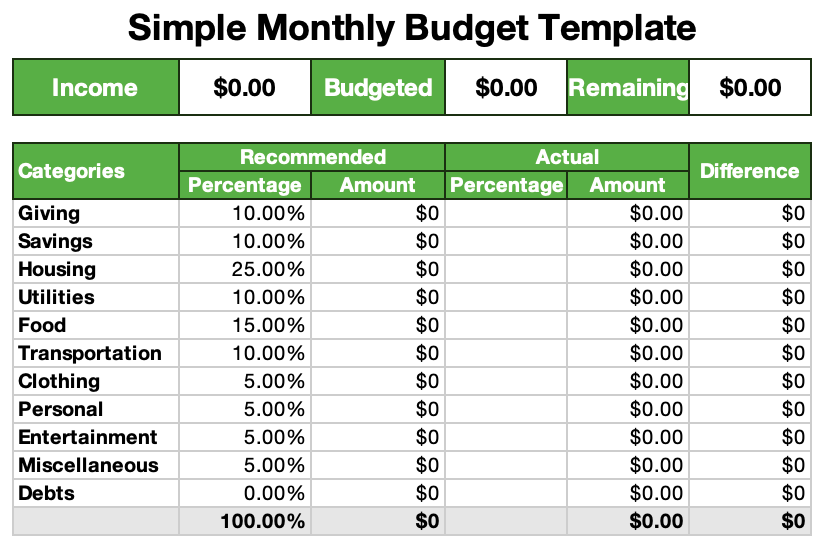

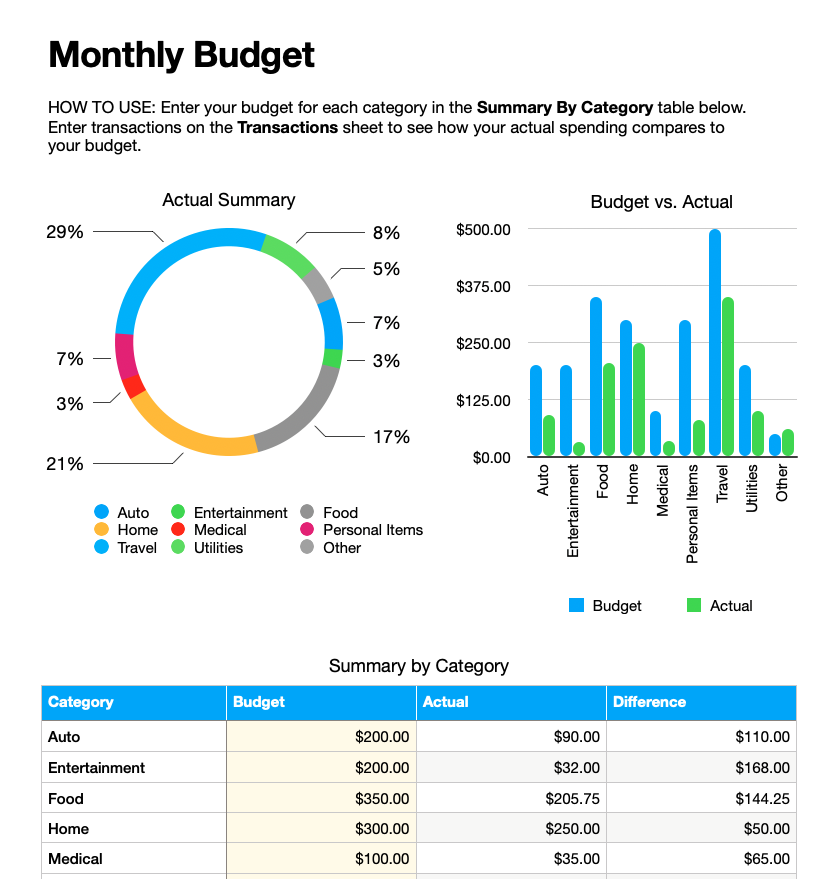

budget templates

Easy-to-use templates to prepare your monthly budget whether you are a free spirit or a math whiz.

budget templates

Easy-to-use templates to prepare your monthly budget whether you are a free spirit or a math whiz.

Click icons below for more information

EveryDollar

One of the best budgeting apps on the market. This app is easy to use and allows you to create a budget in minutes – for free!

Note: There is a paid version (Everydollar Plus) that will allow you to sync your banking information.

- Easy to set up.

- Create custom categories

- Can budget irregular income.

- Goal setting features

Cons: A monthly subscription is required (Everydollar Plus) to sync your banking information.

Intuit Mint

This app allows you to sync your bank accounts, bills and more – FOR FREE. An easy app to use with many features to track your finances including your budget, investments, and more.

- Easy to set up.

- Import banking, bills, and retirement and accounts for free.

- Can be linked with Turbotax automatically.

- Goal setting features

Cons:

- Category limitations

- Too many advertisements and upsells.

This app allows you to sync your bank accounts, bills and more – FOR FREE. An easy app to use with many features to track your finances including your budget, investments, and more.

- Easy to set up.

- Import banking, bills, and retirement and accounts for free.

- Can be linked with Turbotax automatically.

- Goal setting features

Cons:

- Category limitations

- Too many advertisements and upsells.

Honeydue

This app has been designed to allow 2-way in-app communication between couples to help in managing finances.

- Easy to set up.

- Import banking, loan, and investment accounts from over 20,000 institutions for free.

- In-app messaging feature to aide in communication.

- Reminders for bills due.

Cons:

- Category limitations

- A lot of ads and upsells.

Personal Capital

A delightful app that shows you every aspect of your finances in one app. With the ability to sync your bank accounts, this app has many features to manage your money.

- Relatively easy to set up.

- A ton of features to track every aspect of your finances.

- Create custom categories

- Goal setting features

- Overwhelming amount of features can be distracting for beginners.

- Recommendations are not personalized to your situation.

- Many advertisements and upsells.

Good Budget

Using the “envelope system”, this app is very useful for budget and debt tracking. Good for people who want a very basic way to manage their spending.

Note: There is a paid version (Goodbudget Plus) that gives you a few more features.

- Simple to set up and use.

- Create custom categories

- Goal setting features

Cons: Useful for budgeting but not much else.

budget apps

Manage your budget on any computer or mobile device.

We do not receive any type of compensation for these endorsements.

budget apps

Manage your budget on any computer or mobile device.

We do not receive any type of compensation for these endorsements.

Click below for more information

EveryDollar

One of the best budgeting apps on the market. This app is easy to use and allows you to create a budget in minutes – for free!

Note: There is a paid version (Everydollar Plus) that will allow you to sync your banking information.

- Easy to set up.

- Create custom categories

- Can budget irregular income.

- Goal setting features

Cons: A monthly subscription is required (Everydollar Plus) to sync your banking information.

Intuit Mint

This app allows you to sync your bank accounts, bills and more – FOR FREE. An easy app to use with many features to track your finances including your budget, investments, and more.

- Easy to set up.

- Import banking, bills, and retirement and accounts for free.

- Can be linked with Turbotax automatically.

- Goal setting features

Cons:

- Category limitations

- Too many advertisements and upsells.

This app allows you to sync your bank accounts, bills and more – FOR FREE. An easy app to use with many features to track your finances including your budget, investments, and more.

- Easy to set up.

- Import banking, bills, and retirement and accounts for free.

- Can be linked with Turbotax automatically.

- Goal setting features

Cons:

- Category limitations

- Too many advertisements and upsells.

Honeydue

This app has been designed to allow 2-way in-app communication between couples to help in managing finances.

- Easy to set up.

- Import banking, loan, and investment accounts from over 20,000 institutions for free.

- In-app messaging feature to aide in communication.

- Reminders for bills due.

Cons:

- Category limitations

- A lot of ads and upsells.

Personal Capital

A delightful app that shows you every aspect of your finances in one app. With the ability to sync your bank accounts, this app has many features to manage your money.

- Relatively easy to set up.

- A ton of features to track every aspect of your finances.

- Create custom categories

- Goal setting features

- Overwhelming amount of features can be distracting for beginners.

- Recommendations are not personalized to your situation.

- Many advertisements and upsells.

Good Budget

Using the “envelope system”, this app is very useful for budget and debt tracking. Good for people who want a very basic way to manage their spending.

Note: There is a paid version (Goodbudget Plus) that gives you a few more features.

- Simple to set up and use.

- Create custom categories

- Goal setting features

Cons: Useful for budgeting but not much else.

Make a plan for your money and your future

If you do not have a budget, on paper, it will be hard to win with money.

Book a session today to get a personalized plan to do more with your money.

Make a plan for your money and your future

If you do not have a budget, on paper, it will be hard to win with money.

Book a session today to get a personalized plan to do more with your money.

“If you fail to plan, you plan to fail”” – Benjamin Franklin

A budget is simply a WRITTEN RECORD of the income and expenses that you EXPECT to have for a given period of time.

Many people cringe at that word but a budget is just YOUR plan to save, give, or spend YOUR money.

“If you fail to plan, you plan to fail”” – Benjamin Franklin

A budget is simply a WRITTEN RECORD of the income and expenses that you EXPECT to have for a given period of time.

Many people cringe at that word but a budget is just YOUR plan to save, give, or spend YOUR money.

Only around 1/4 of Americans have some kind of written financial plan

Only around 1/4 of Americans have some kind of written financial plan

budget templates

Easy-to-use templates to prepare your monthly budget whether you are a free spirit or a math whiz.

budget templates

Easy-to-use templates to prepare your monthly budget whether you are a free spirit or a math whiz.

Click icons below for more information

EveryDollar

One of the best budgeting apps on the market. This app is easy to use and allows you to create a budget in minutes – for free!

Note: There is a paid version (Everydollar Plus) that will allow you to sync your banking information.

- Easy to set up.

- Create custom categories

- Can budget irregular income.

- Goal setting features

Cons: A monthly subscription is required (Everydollar Plus) to sync your banking information.

Intuit Mint

This app allows you to sync your bank accounts, bills and more – FOR FREE. An easy app to use with many features to track your finances including your budget, investments, and more.

- Easy to set up.

- Import banking, bills, and retirement and accounts for free.

- Can be linked with Turbotax automatically.

- Goal setting features

Cons:

- Category limitations

- Too many advertisements and upsells.

This app allows you to sync your bank accounts, bills and more – FOR FREE. An easy app to use with many features to track your finances including your budget, investments, and more.

- Easy to set up.

- Import banking, bills, and retirement and accounts for free.

- Can be linked with Turbotax automatically.

- Goal setting features

Cons:

- Category limitations

- Too many advertisements and upsells.

Honeydue

This app has been designed to allow 2-way in-app communication between couples to help in managing finances.

- Easy to set up.

- Import banking, loan, and investment accounts from over 20,000 institutions for free.

- In-app messaging feature to aide in communication.

- Reminders for bills due.

Cons:

- Category limitations

- A lot of ads and upsells.

Personal Capital

A delightful app that shows you every aspect of your finances in one app. With the ability to sync your bank accounts, this app has many features to manage your money.

- Relatively easy to set up.

- A ton of features to track every aspect of your finances.

- Create custom categories

- Goal setting features

- Overwhelming amount of features can be distracting for beginners.

- Recommendations are not personalized to your situation.

- Many advertisements and upsells.

Good Budget

Using the “envelope system”, this app is very useful for budget and debt tracking. Good for people who want a very basic way to manage their spending.

Note: There is a paid version (Goodbudget Plus) that gives you a few more features.

- Simple to set up and use.

- Create custom categories

- Goal setting features

Cons: Useful for budgeting but not much else.

budget apps

Manage your budget on any computer or mobile device.

We do not receive any type of compensation for these endorsements.

budget apps

Manage your budget on any computer or mobile device.

We do not receive any type of compensation for these endorsements.

Click below for more information

EveryDollar

One of the best budgeting apps on the market. This app is easy to use and allows you to create a budget in minutes – for free!

Note: There is a paid version (Everydollar Plus) that will allow you to sync your banking information.

- Easy to set up.

- Create custom categories

- Can budget irregular income.

- Goal setting features

Cons: A monthly subscription is required (Everydollar Plus) to sync your banking information.

Intuit Mint

This app allows you to sync your bank accounts, bills and more – FOR FREE. An easy app to use with many features to track your finances including your budget, investments, and more.

- Easy to set up.

- Import banking, bills, and retirement and accounts for free.

- Can be linked with Turbotax automatically.

- Goal setting features

Cons:

- Category limitations

- Too many advertisements and upsells.

This app allows you to sync your bank accounts, bills and more – FOR FREE. An easy app to use with many features to track your finances including your budget, investments, and more.

- Easy to set up.

- Import banking, bills, and retirement and accounts for free.

- Can be linked with Turbotax automatically.

- Goal setting features

Cons:

- Category limitations

- Too many advertisements and upsells.

Honeydue

This app has been designed to allow 2-way in-app communication between couples to help in managing finances.

- Easy to set up.

- Import banking, loan, and investment accounts from over 20,000 institutions for free.

- In-app messaging feature to aide in communication.

- Reminders for bills due.

Cons:

- Category limitations

- A lot of ads and upsells.

Personal Capital

A delightful app that shows you every aspect of your finances in one app. With the ability to sync your bank accounts, this app has many features to manage your money.

- Relatively easy to set up.

- A ton of features to track every aspect of your finances.

- Create custom categories

- Goal setting features

- Overwhelming amount of features can be distracting for beginners.

- Recommendations are not personalized to your situation.

- Many advertisements and upsells.

Good Budget

Using the “envelope system”, this app is very useful for budget and debt tracking. Good for people who want a very basic way to manage their spending.

Note: There is a paid version (Goodbudget Plus) that gives you a few more features.

- Simple to set up and use.

- Create custom categories

- Goal setting features

Cons: Useful for budgeting but not much else.

Make a plan for your money and your future

If you do not have a budget, on paper, it will be hard to win with money.

Book a session today to get a personalized plan to do more with your money.

Make a plan for your money and your future

If you do not have a budget, on paper, it will be hard to win with money.

Book a session today to get a personalized plan to do more with your money.

Have you tried our Financial Health Assessment?

also Explore these other free tools and resources

Tools

Useful tools to help you track, manage and understand your money

Webinars

Virtual classes for people of all ages discussing a wide range of topics.