tools

Track, manage, and understand your money

Financial Health Assessment

Gauge you current financial situation

Budget Templates

Manage and track your money

Desktop & Mobile Apps

Manage your money from anywhere

Financial Calculators

Determine how much you should pay

financial health assessment

Gauge your current financial situation

Disclaimer

The use of this tool is provided for generalized informational and illustrative purposes only. The tools offered on this site are designed to provide accurate information, but your individual situation may necessitate analysis of additional factors not accounted for by this site or its tools. When making decisions regarding financial transactions or considering the information provided by this tool, you should consult licensed professionals. Providence Financial Solutions, and its affiliates, do not provide legal, accounting, insurance or other professional advice. The information generated by this tool depends upon the information you supply and therefore we do not warrant any results or information generated by this tool. The information you supply may be stored and used to offer you products or services we think you may like. By using this site and its tools you represent and warrant that you are not using this site for any unlawful or illegal purpose.

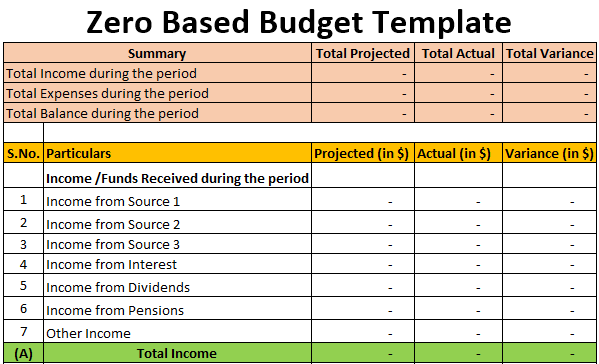

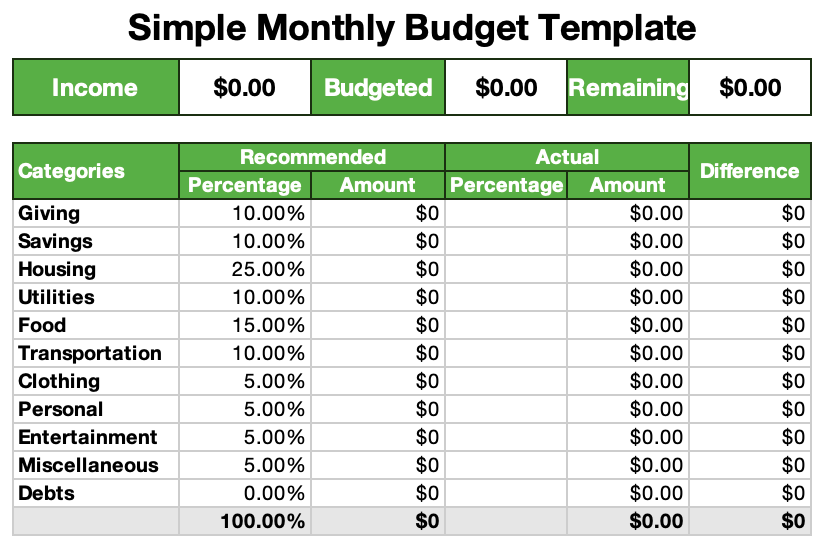

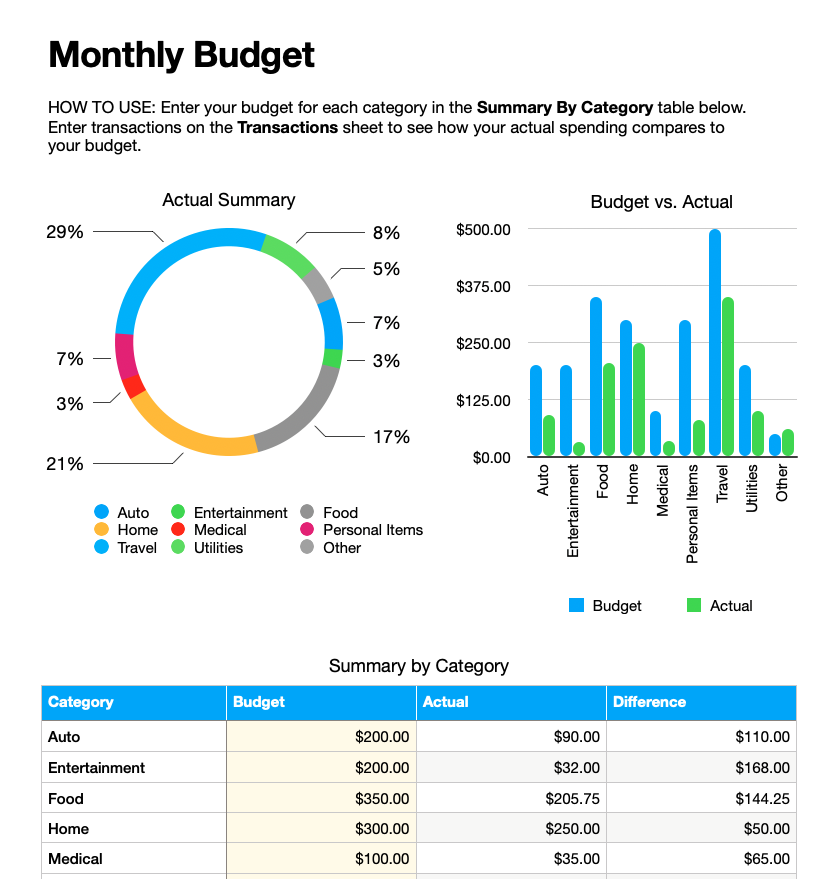

budget templates

Manage and track your money

"If you fail to plan, you plan to fail"

– Benjamin Franklin

Use these easy-to-use templates to prepare your monthly budget whether you are a free spirit or a math whiz.

budget apps

Manage your money from anywhere

Manage your budget on any computer or mobile device.

We do not receive any type of compensation for these endorsements.

Click icons below for more information

EveryDollar

One of the best budgeting apps on the market. This app is easy to use and allows you to create a budget in minutes – for free!

Note: There is a paid version (Everydollar Plus) that will allow you to sync your banking information.

- Easy to set up.

- Create custom categories

- Can budget irregular income.

- Goal setting features

Cons: A monthly subscription is required (Everydollar Plus) to sync your banking information.

Intuit Mint

This app allows you to sync your bank accounts, bills and more – FOR FREE. An easy app to use with many features to track your finances including your budget, investments, and more.

- Easy to set up.

- Import banking, bills, and retirement and accounts for free.

- Can be linked with Turbotax automatically.

- Goal setting features

Cons:

- Category limitations

- Too many advertisements and upsells.

This app allows you to sync your bank accounts, bills and more – FOR FREE. An easy app to use with many features to track your finances including your budget, investments, and more.

- Easy to set up.

- Import banking, bills, and retirement and accounts for free.

- Can be linked with Turbotax automatically.

- Goal setting features

Cons:

- Category limitations

- Too many advertisements and upsells.

Honeydue

This app has been designed to allow 2-way in-app communication between couples to help in managing finances.

- Easy to set up.

- Import banking, loan, and investment accounts from over 20,000 institutions for free.

- In-app messaging feature to aide in communication.

- Reminders for bills due.

Cons:

- Category limitations

- A lot of ads and upsells.

Personal Capital

A delightful app that shows you every aspect of your finances in one app. With the ability to sync your bank accounts, this app has many features to manage your money.

- Relatively easy to set up.

- A ton of features to track every aspect of your finances.

- Create custom categories

- Goal setting features

- Overwhelming amount of features can be distracting for beginners.

- Recommendations are not personalized to your situation.

- Many advertisements and upsells.

Good Budget

Using the “envelope system”, this app is very useful for budget and debt tracking. Good for people who want a very basic way to manage their spending.

Note: There is a paid version (Goodbudget Plus) that gives you a few more features.

- Simple to set up and use.

- Create custom categories

- Goal setting features

Cons: Useful for budgeting but not much else.

calculators

Use these to evaluate current or future projections

Income

Use these to calculate how much you could be bringing home.

Debt and Loans

Use this to see how long it will take to pay off debt..

Savings

Use this to see how much your money will grow.

Retirement

How retirement works and what works best for you

Real Estate

Learn more about the value of property ownership

Education

Use this to see how much it will take to go to college.

Insurance

Compare coverages and rates that best meet your needs.

NOTE: We only recommend term life insurance at 10-12 times your annual income.

Taxes and Other

Calculate taxes for various cases.

also Explore these other free tools and resources

Resources

A large collection of information to help you win with money.

Webinars

Virtual classes for people of all ages discussing a wide range of topics.

15-minute consultation

Get answers to any financial questions and concerns you may have.